Clean Energy Tool

Reliable, consistent and digestible information for investment in clean energy projects around the world.

Reliable, consistent and digestible information for investment in clean energy projects around the world.

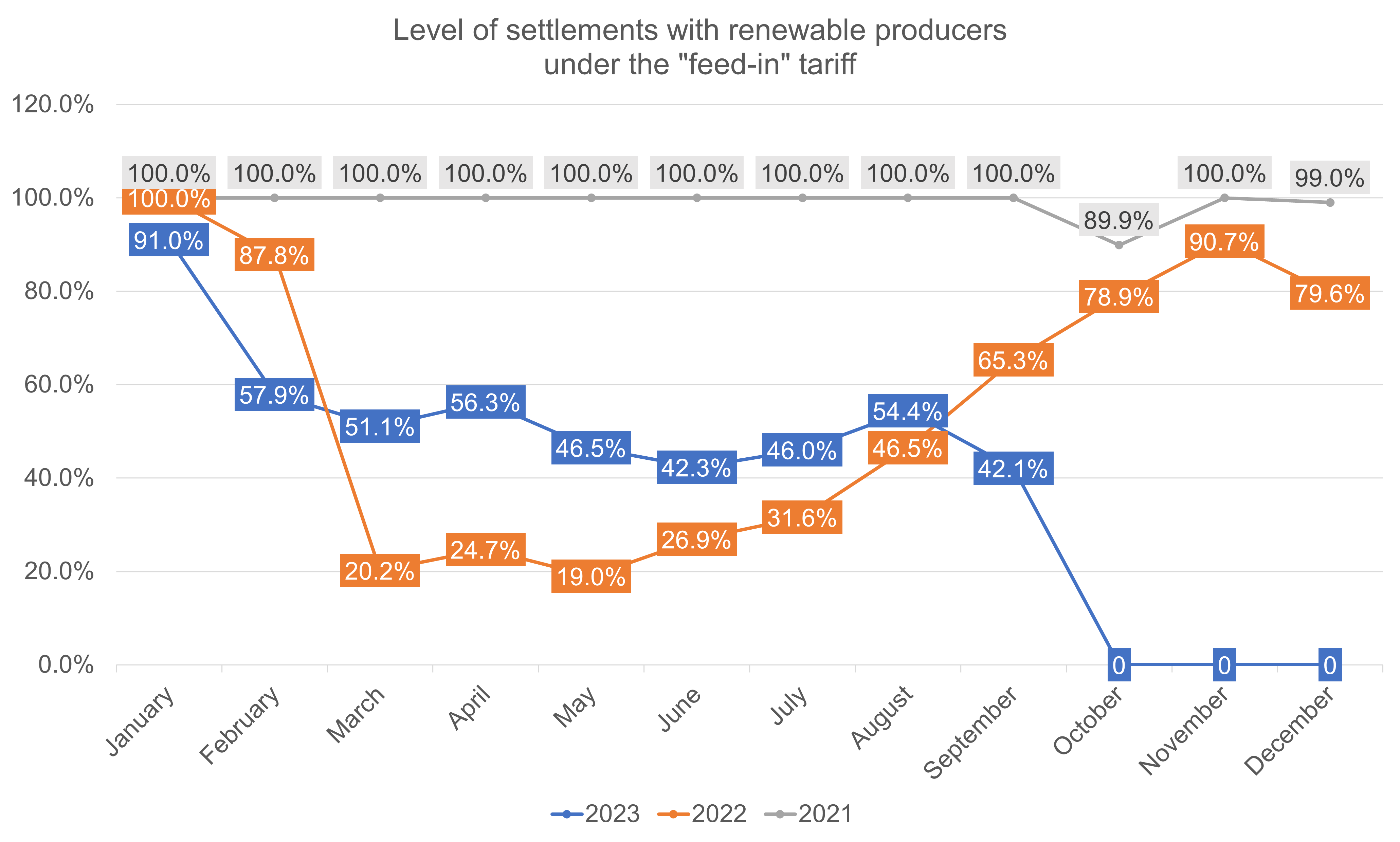

Guaranteed Buyer reaches a partial settlement with RES producers but its debt is still rising

In the first 10 days of September, SE Guaranteed Buyer reported that 42.1% of the payments for renewable energy have been made. Considering this early-month data, the entire month's payment might surpass the August figure, which was 54.4%. However, there remains a significant financial hurdle.

Currently, NEC Ukrenergo has accumulated a debt of UAH 29.6 billion owed to SE Guaranteed Buyer for RES services, a large part of which arises from unfulfilled obligations related to the transmission tariff - a critical component of FIT financing in Ukraine.

Currently, Ukrenergo is working with the European Bank for Reconstruction and Development to secure a USD 150-200 million loan to cover the debt to the Guaranteed Buyer, which was recently stated by the head of the council of the Ukrainian Association of Renewable Energy, Stanislav Ignatiev.

Corporatisation of SE Guaranteed Buyer is coming

The corporatisation process of SE Guaranteed Buyer has become possible after the enactment of the Green Transformation Law (please see our earlier publication for further details), which excludes the statutory requirement regarding the establishment of the Guaranteed Buyer in the form of a state enterprise and conveying that the Guaranteed Buyer’s function may be performed by a public sector entity.

This does not mean that the function of the guaranteed recipient of the electricity produced under the feed-in tariff will be transferred to a different entity, but instead that SE Guaranteed Buyer will be transformed into a joint-stock company. After the transformation, a supervisory board consisting of reputable market experts will be formed, and the company’s business processes will also become more transparent and open. Currently the draft regulations for the corporatisation of SE Guaranteed Buyer are undergoing the review and approval process by various government authorities. The chairman of SE Guaranteed Buyer estimates that corporatisation could be completed during the next 6-12 months.

The first instance of a large wind power producer marketing its electricity without benefit of the state’s support scheme

Effective September 1, 2023, the first phase of DTEK’s Tyligul wind power plant (119 MW), built during the full-scale war, has withdrawn from the feed-in tariff support scheme and switched to selling its electricity on the free market. DTEK reports that the first phase has been operating in the market since June 2023. This allows sufficient cash flow generation to ensure the wind power plant’s stable operation and to service debt obligations. Since the market model has proven its reliability, the plant’s management decided to sell the entire volume of electricity generated by the first phase of the Tyligul wind power plant on the market.

The Tyligul wind power plant is located in the Mykolaiv Region. Its design capacity is 500 MW, and it has 83 wind turbines. DTEK currently is looking for investment to fund the development of the wind power plant’s second phase.

The Regulator has decided on a cross-border capacity allocation mechanism between Ukraine and Slovakia, Poland, and Hungary

On September 12, 2023, the National Energy and Utilities Regulatory Commission (NEURC, the Regulator) approved the rules for the allocation of cross-border capacity for Ukrainian interconnections with Poland, Slovakia, and Hungary at daily auctions to be held on the Joint Allocation Office (JAO) auction platform.

This decision has been preceded by an agreement reached by transmission system operators from Ukraine, Slovakia, Hungary, and Romania to introduce a jointly coordinated cross-border capacity allocation procedure based on the JAO platform in June 2022. Poland has since adhered to this agreement.

The new mechanism will contribute to energy security and the stable function of all participating countries’ energy systems.

On September 12, the Regulator also decided on the allocation of 100% of all available cross-border capacity with Slovakia in daily auctions and instructed the national Transmission System Operator, Ukrenergo, to present operators from Poland, Hungary, and Slovakia with a proposal to agree on the allocation of capacity in monthly and annual auctions. According to earlier reports, Ukraine and Romania agreed that 35% of cross-border capacity could be allocated at annual auctions, 35% at monthly auctions, and 30% at daily auctions.

Kostiantyn Ushchapovskiy, the Ukrainian Regulator’s chairman, claims that the availability of long-term arrangements for the allocation of cross-border capacity is the main precondition for the stable import and export of electricity. Ukrenergo’s representatives claim that the availability of monthly and annual auctions is an issue to be resolved jointly with system operators from the respective countries. Some countries refuse to switch to monthly and annual auctions due to an ENTSO-E decision that forbids such auctions with Ukraine while it is in a state of martial law. Yet Ukrenergo provides no explanation for how the Romanian system operator managed to reach an agreement to allocate 70% of its cross-border capacity with Ukraine in monthly and annual auctions despite the said prohibition issued by ENTSO-E.

The Regulator introduces a comprehensive registration procedure for wholesale energy market participants

On 4 October 2023, the National Energy and Utilities Regulatory Commission (NEURC, the Regulator) adopted a regulation that establishes the registration rules for participants in the wholesale energy market. The regulation was developed within the framework of the Law of Ukraine, "On Amendments to Certain Laws of Ukraine on Prevention of Abuse in Wholesale Energy Markets" №3141-ІХ (the "Law on REMIT" following the approximation of the EU REMIT Directive) and outlines the details of the registration process and requirements for potential participants.

The scope of this regulation encompasses a broad range of wholesale market participants, including electricity producers, gas extraction enterprises, gas storage operators, gas transmission and distribution system operators, market operators, electricity transmission and distribution system operators, LNG storage and facility operators, as well as traders and major consumers of electricity and natural gas (600 GWh per year and above).

An integral part of this new procedure is the establishment of a public registry of participants, accessible through the Regulator's official website. This ensures the process’ transparency and openness. The regulation details a registration procedure that requires entities interested in trading wholesale energy products to register as market participants before entering into any agreements. Notably, this registration is a singular requirement, regardless of the scope or type of their market activities.

The registration procedure requires the submission of a registration form by an authorized representative. This form is subject to the Regulator's verification for its completeness and compliance with the established procedure. Upon successful completion of the process a participant is assigned an ECRB code, and their details are incorporated into the registry.

In accordance with the regulation, an active registration phase will commence on 15 October 2023. However, there are clear criteria that could result in a declined application: unverified authority when applying, discrepancies between the form's information and state registry data, incorrect form completion, and control over the business entity by aggressor countries. If the application is declined, the Regulator must provide the applicant with specific reasons within a three-day period. Applicants can then legally challenge this decision should they wish.

The Regulator has approved a procedure for the investigation of energy market abuse

On 26 September 2023, the National Energy and Utilities Regulatory Commission (NEURC, the Regulator) adopted a regulation, "On the Approval of the Procedure for Investigating Abuse in the Wholesale Energy Markets" ("Market Abuse Investigations Regulation”). This initiative is a step towards unfolding the regulatory infrastructure necessary for the proper implementation of the Law on REMIT, dated 10 June 2023, which implements the requirements of the EU REMIT Directive concerning the transparency of wholesale energy markets.

According to the Market Abuse Investigations Regulation, the Regulator has the authority to initiate investigations based on submissions from applicants or independently, if there are grounds for such, particularly based on the analysis of the participant’s market behaviour. The investigation process includes several stages, such as preliminary research, conducting hearings, and reaching a final decision. It's noteworthy that market participants are obligated to actively cooperate with the Regulator during an investigation and provide all necessary information related to the case.

Upon the investigation’s completion, the Regulator makes a decision regarding the identified violations, the possible application of sanctions, or other measures in accordance with the law. In cases where violations are not detected or evidence is found insufficient, the investigation may be closed. It's worth noting that the Regulator’s decisions are subject to judicial review.

Memorandum Of Understanding between the Government of Ukraine and the Government of the United States of America regarding Collaboration on Ukrainian Energy System Resilience

On September 24, 2023, The U.S. Embassy in Ukraine published the text of the Memorandum of Understanding between the Government of Ukraine and the Government of the United States of America regarding Collaboration on Ukrainian Energy System Resilience.

The MoU aims to enhance the resilience of Ukraine's energy system. It focuses on restoring vital infrastructure, introducing distributed generation, reforming the energy sector, and aiding Ukraine's transition to a green, competitive energy economy that is integrated with the EU.

The cooperation is to take place in the following areas:

• Restoration of Ukraine’s damaged electricity, heating, and gas infrastructure, including the purchase and installation of main lines autotransformers.

• Strengthening the resilience of the power system through increased adequacy and flexibility, including improvement of resiliency to power disruptions in essential services sectors like heating, water, sanitation, transport, telecommunications, and health;

• Installation of distributed gas generation (including CCGT turbines of USA production);

• Expansion of distributed generation from renewable and other energy sources in the power and heat sectors;

• Strengthening of Ukraine’s physical interconnection with European gas and electricity networks;

• Development and implementation of energy sector reforms consistent with European Union acquis and in accordance with Ukraine’s Energy Community Treaty obligations;

• Civil nuclear energy cooperation;

• Protection of Ukraine’s most critical energy infrastructure, including but not limited to areas such as physical anti-drone and anti-missile defence, physical and cyber security as well as the identification of cross-sectoral interdependencies and implementation of mitigation measures to prevent cascading failures due to potential power supply disruption.

Under the MoU, Ukraine commits to regularly updating its strategy for restoring the nation's energy infrastructure and enacting necessary legal reforms. In return, the U.S. Government plans to provide Ukraine with a total of USD 522 million in assistance, of which USD 422 million is allocated for new energy aid. An additional USD 100 million will be provided contingent on Ukraine achieving specific milestones, including the establishment of a Supervisory Board of the Gas TSO of Ukraine LLC, progression in the corporatisation of SE NNEGC Energoatom, and adherence to REMIT legislation requirements by set deadlines.

The MoU is aligned with the 1992 Agreement between Ukraine and the USA on Humanitarian and Technical Economic Cooperation, including tax and customs exemptions. The MOU is set for a one-year duration but can be extended through mutual agreement.

The Vinnytsia Poultry Farm boosts its biomethane production with a USD 30 million IFC investment

The International Finance Corporation (IFC) will lend the MHP Group’s Vinnytsia Poultry Farm up to USD 30 million for the modernisation and expansion of a plant that produces biomethane from agricultural waste.

MHP Group, a leader in Ukraine's poultry industry, is placing a strong emphasis on biomethane. They currently operate two biogas plants that transform farm waste into clean energy. As part of their commitment to greener energy, the group plans to increase its biomethane production. They're doing this by upgrading and expanding their existing biogas facilities in stages.

The project's total cost is about USD 52 million. MHP plans to use some of its own funds for this venture. The company also expects to receive financial support, including USD 15 million in guarantees, from sources like the European Fund for Sustainable Development Plus and the UK.

Highlighting the project's scale, the Vinnytsia biogas plant, operational since 2019, is Ukraine's largest of its kind. The first stage focuses on improving the existing infrastructure to yield 14,000 tonnes of liquefied methane annually and a later phase will increase its overall capacity to 20.5 MW.

sophisticated solutions for businesses on their way to carbon neutrality

WE HELP WITH